|

I'm new to travel hacking with credit cards. Some may consider it "churning," where you open a bunch of new credit cards all at once every three months or so, and then cancel them about 11 months after opening them to avoid an annual fee (as an example). One of the most common questions I'm asked is "does it hurt your credit score?"

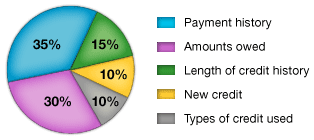

Has my credit score taken a hit? No. It's actually the opposite. Since I've started building more credit, my score has gone up about 15 points (and now above 800) in 6 months. Why? Well, your credit score is based on several factors. FICO, one of the companies that determines your credit score, for example, bases credit scores on:

Payment history: The biggest chunk of the pie (at 35%) is your payment history. If you consistently pay off your credit on time, you're off to a good start.

Amounts owed: The next biggest piece of pie (at 30%) is the amount you owe. What does that mean? Well, for example, let's say you have the Chase Sapphire Preferred card and you have a line of credit on that card of $10,000. First of all, congrats! That's really cool. So you celebrate by buying $4,000 of stuff that all goes on your CSP. If that's your only card, you are using 40% of your available credit. Not cool anymore. If you apply for another card and you still owe $4,000, that's not gonna look good to FICO. A general rule of thumb is keep the percentage under 30%. This is not to say you can't use up 40% or 50% of your credit, but pay it off before applying for a mortgage, car loan, business loan, another credit card, or any other big purchase where your credit score will be looked up. Because, remember, that's 30% of your credit score.

Types of credit used: According to FICO this means your "mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans." Having your credit diversified is not a bad idea, and I think this is something that kind of just happens with life. You'll buy a new car, buy a new house, etc. This, by default will diversify your credit.

To sum it up In short, if you pay off each card (ideally in full) each month, don't miss payments, keep the amount of credit you've used at 30% or under, keep your oldest credit card, get new credit every now-and-then, and diversify, your credit score will be high and stay high. I'm certainly no expert, but this is just what I've learned in the short amount of time I've been doing this. Practicing what I just "preached" has helped my credit score go up. And in all likelihood will help your credit score too. Do your own research and learn more about it yourself. It certainly can't hurt.

Related:

-The Biggest Mistakes You Make With Your Finances -Cheap Gas Prices: The Good And The Bad -American Express Launches Loyalty Program Plenti

2 Comments

Mary Jo Johnso

1/16/2015 12:49:24 pm

Thanks. I wondered about this question of changing your credit. Love using the miles.

Reply

Keith King

1/16/2015 01:39:02 pm

Not a problem! I'm glad this helped. The miles are great! They're a blast to earn AND use!

Reply

Leave a Reply. |

Stay inspired with The KKR in Your EmailCategories

All

|

RSS Feed

RSS Feed