|

So you’re going on vacation. And you’ve already booked the flight, the hotel, and found a few fun sightseeing things to do while there. Almost everything that can be taken care of beforehand has been. However, there’s still one glaring question you need to answer: how much cash should you take with you (yes, I’m talking about the green stuff...er... at least that’s the color of cash in the U.S.)? Here are a few tips to help you figure that out: Do your homework

1 Comment

There are a lot of people out there that don’t like credit cards. I don’t know if “scared” is the right word, but it seems to fit. They’re scared that all the perks you may get by signing up for a credit card is too good to be true. They’re scared that they may start to use a credit card for what banks hope you use it for: living today on tomorrow’s (possible) income. Indeed, if you use credit cards like that, you’ll be up a creek… and it won’t smell anything like flowers.

Why the hostility towards credit cards? So far this year, I’ve spent way more than should be legal on my wedding. But it’s not all bad! I’ve put most of that on credit cards trying to maximize my earning potential when it comes to points and miles. You see, I’ve figured out first hand that expenses can add up quickly when planning a wedding, but using the right credit cards for wedding and honeymoon purchases can pay off big time for future travel. Including bonuses, I’ve earned: It’s true: I’ve been talking about how you can save a ton on travel with credit cards as of late. I mean, I did write a book on it. So sue me. Oh! And you can buy it here if you’d like. You’re welcome :) Anyways, where was I? Right: saving on travel. There are plenty of other ways to go about saving money while traveling. I wrote about a couple of them here. Unfortunately, when it comes to flights - the "deals" are harder to come by. It’s just the way it is. So what can you do to fly on the cheap? Don’t believe everything you hear Sometimes it feels like you have to do a reverse mortgage on your house (does anyone really know what that is, btw?) just to take a vacation! Maybe that’s why many Americans don’t take all of their allotted vacation time they get from work. Seriously, though. Vacations are expensive. And if you don’t do your research, planning, and saving beforehand, it could be devastating to your credit score.

Side hustles are all the rage today. You’ve got Uber promoting themselves as a part time job. Then there’s Lyft, Favor, and about a gazillion other things you can do to earn some extra cash. Even our current president has a side gig.

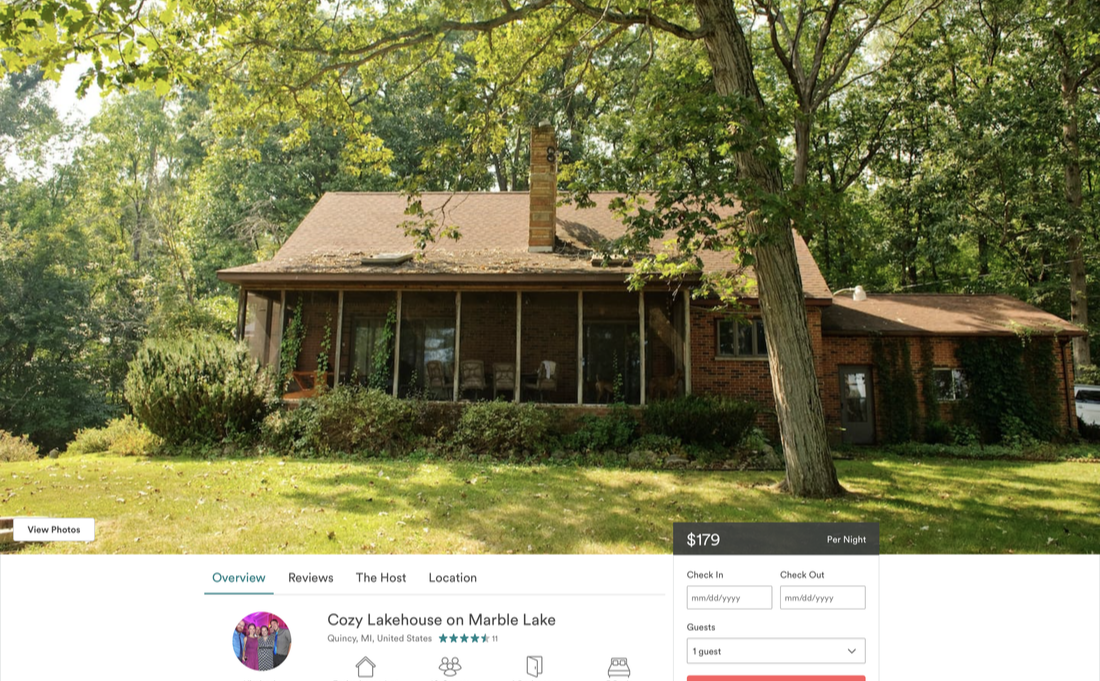

But those options are just the tip of the iceberg! So what can you do to earn thousands in extra income every year? Well, the following are great options: Airbnb is changing the way people travel. Since their founding in 2008, they have exploded into a multi-billion dollar company that gives travelers more choices when it comes to lodging.

And the company isn’t only great for travelers, it’s also a great way to make a little extra cash when you’re not traveling (which can then help fund your next vacation!). But how much can you actually make? I’ll break it down for ya.

Starbucks. What would I do without you?! And whatever you may think of the coffee chain, it’s one of the most successful businesses in the world. That’s because, since the return of their CEO Howard Schultz, the company has made smart business decisions.

One of those smart decisions: change the way their loyalty program works. Come April, the Starbucks Rewards program is going to be revenue based, which is a big change from what it is now. Getting a travel credit card (or two) is great. But once the honeymoon period, if you will, is over it can be tough to know how to maximize the spending of those cards. Plus, the last thing you want to do is go into debt to get points. So how do you find the happy medium? How do you maximize spending without going overboard?

Here are several items/purchases you can make to earn more credit card points than you ever have: It’s October. And that means many things. It means cooler temperatures for many. It means Halloween for others. It means playoff baseball. Heck, it also means the holiday season is nearly here!

But there’s also something else the month of October means: breast cancer awareness month. If you can, I encourage you to donate. There are many ways you can go about doing so. Some are better than others. And some give you something in return (besides that good feeling you get when you do donate). It used to be something quite common: bereavement fares for flights. But over the last decade or so, they’ve slowly gone extinct. There are still some airlines that offer a bereavement fare, like Delta and Alaska Airlines, but most airlines have done away with them. And even if you can find a bereavement fare, oftentimes you’ll have to jump through hoops to get them (annoying for someone that didn’t just lose a loved one, let alone someone who is in a grief filled haze).

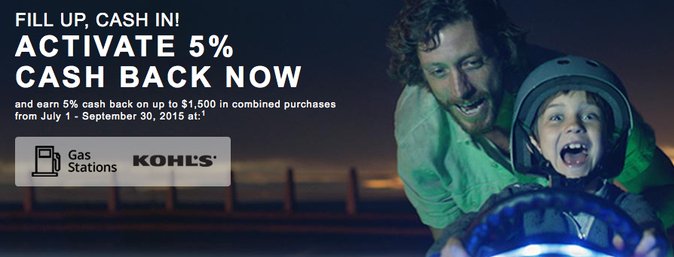

I’ve said it before and I’ll say it again, the Chase Freedom is one of my favorite cards to use. Not only is it a no-annual-fee card, but it also offers a 5x bonus on rotating categories every quarter (up to $1,500 in spend). In order to take advantage of these bonuses, you need to activate it. If you do the math, this means you can earn $300 every year if you max out each quarter. It gets even better if you pair the Freedom with the Chase Sapphire Preferred, which can turn that $300 into an amount much closer to $600.

Who doesn't like free money? The thing is not everyone has enough free time to get a second job, or do a side hustle. If that pretty much describes you, rest easy! That’s because making extra money doesn't always have to include work. One of the easiest ways you'll ever see that dough rise in your bank account is to open another bank account. That's right. Banks try to lure customers by offering perks. All you need to do to take advantage - is to open an account. Easy. As. That.

It’s called chasing sign-up bonuses and some people do this kind of thing on a regular basis. You can do it with credit cards and bank accounts. I’ve done both, and neither one takes much time. As of late, I’ve been focusing more on chasing credit card sign-up bonuses, but I recently started thinking about opening another bank account to reap the rewards. It only takes about 30 minutes (give or take a few) to open up a bank account, so time really isn’t a factor here. And most bonuses you’ll get after three, or six months are more lucrative than keeping that same amount of money in a savings account for the same amount of time. For example, if you open an account with $1,500, and get a bonus of $100 after six months you’ll close that account with $1,600 in your pocket. If you left that same $1,500 in a savings account you’d get less than $10 in interest in six months. Which one would you pick? Anyways, I figured I’d write this to help me (and hopefully you) decide which banks have the best deals right now. Listed below are some of the better deals I found:

This will probably be the easiest $300 you'll make every frickin' year! And that's not even the best part. What is? It's free. I know what you're thinking: there's gotta be a catch. Well, yes and no. That's because I'm talking about a rewards credit card. But it's one of the best out there, in my opinion. I'm talking about the Chase Freedom Credit Card. It has no annual fee, and is very easy to get for most people out there. According to Credit Karma, if you have a credit score of at least 585 you can get approved. The Freedom was my very first adult credit card out of college! And let me just say, when I graduated college, I had a crappy paying job with very little credit.

Investing your money is not always easy. If you're just getting into it you probably are thinking about nightmare scenarios where the stock market crashes and you lose all your money. Is that kind of thing possible? Sure. Likely? No. That's why it makes headlines when it happens. Because it doesn't happen very often.

By investing your hard earned money you're taking more of a risk, but the reward is far greater. For example, if you keep your money in a normal savings account (we'll pick on Chase today), you'll actually lose money. Chase has an interest rate of 0.03%. That's embarrassingly pathetic. The reason you're "losing" money is because of inflation. In other words, your money (however much you "saved") will buy less this year than last year. Even a savings account that has a better interest rate (like Capital One 360, which I use) is more than likely less than the yearly inflation rate.

On the other hand, if you had any money in, say, an investment account that puts your money into ETFs (which is similar to an index fund) last year, it probably would have grown by about 11%. That's some good growth! Over the long term, you can expect a 6-7% return on their money. This, according to Warren Buffett in a Bloomberg article. I would argue he knows what he's talking about, no? You can (and should) have both a savings and investment account. I think of an investment account as more of a semi long term thing. As an example, if you have cash you don't plan on spending right now, and you want it to grow, an investment account is the way to go. Let's say you've decided to open an investment account. Where do you start? There are several ways you can go about opening one. I'll go through three different ways you can get your money invested. |

Stay inspired with The KKR in Your EmailCategories

All

|

RSS Feed

RSS Feed