|

I’ve said it before and I’ll say it again, the Chase Freedom is one of my favorite cards to use. Not only is it a no-annual-fee card, but it also offers a 5x bonus on rotating categories every quarter (up to $1,500 in spend). In order to take advantage of these bonuses, you need to activate it. If you do the math, this means you can earn $300 every year if you max out each quarter. It gets even better if you pair the Freedom with the Chase Sapphire Preferred, which can turn that $300 into an amount much closer to $600.

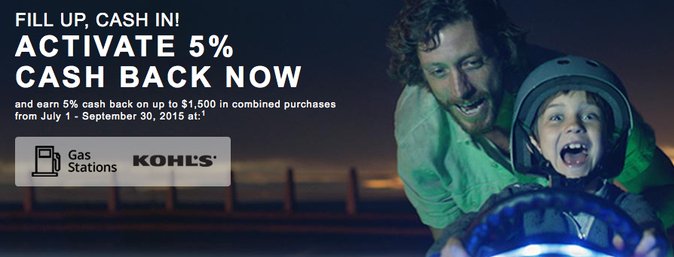

Now is the time to sign up for third quarter bonuses

Go ahead and do that before you forget. You don’t want to miss out on any potential earnings just because you forgot to sign up for the bonus. This year the two major 5x categories in the third quarter are gas stations and Kohl’s. Now, maxing out every quarter isn’t easy, but possible for some. I maxed out the first quarter, which had grocery stores, movie theaters, and Starbucks as categories. I also maxed out the second quarter, which included restaurants, Bed Bath & Beyond, and Overstock.com. I’m thinking the third quarter will be slightly harder to max out for me. I don’t think I spend $1,500 a quarter on gas, and I know I don’t spend that much at Kohl’s...like ever.

Bottom line

The Chase Freedom card is a great card to have in your back pocket. It’s lucrative with just the 5% cash back, and even more so if you’re willing to pay $95 a year for the CSP to pair the two. At the very least, it’s something to think about. Do you have the Freedom? You may also be interested in: -Will Credit Card Churning Hurt my Credit Score? -The VIP Perks you Didn't Know you had -How to Make an Extra $300 Every Year

0 Comments

Leave a Reply. |

Stay inspired with The KKR in Your EmailCategories

All

|

RSS Feed

RSS Feed