|

The Platinum Card by American Express is one of those cards that exudes a bit of clout in the credit card community. That clout seems to have dissipated somewhat as of late, due to stiffer competition like the Chase Sapphire Reserve and the Citi Prestige, but it’s still there. And the Amex Platinum also has quite a few perks up its sleeve that may make the fact that it has a $550 annual fee worth it. Ultimately, though, that’s up to you. This is a charge card First and foremost, I think it’s important to point out that this is a charge card, not a credit card. What’s the difference, you ask? The biggest difference is the fact that a charge card needs to get paid off in full every month. A credit card can carry a balance. But because of that, you will typically have more spending power with a charge card because you won’t have a set limit that you can put on them. Not paying off a charge card will come with severe consequences. Those consequences can include suspending your line of credit entirely. So if you decide to get one, it's best to pay it off. Main card benefits

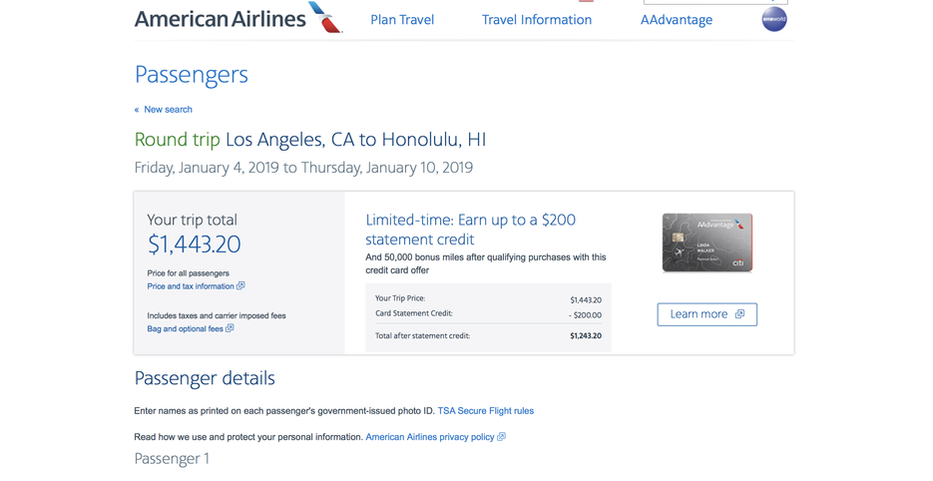

I’ll get a little more specific below. The welcome bonus At the very least, 60,000 Membership Rewards points is worth about $1,200, according to The Points Guy. But you can easily get more value out of that by transferring points to one of Amex’s travel partners. For example, with 60,000 MR points you can get two round trip tickets to Hawaii in economy by transferring 50,000 points to British Airways and take American from Los Angeles or Phoenix. If you paid cash that’ll set you back more than $1,400. Here's a sample below:

$200 airline credit Officially, you can only use it for “incidental” fees, but you can also use it for gift cards for a few airlines. It’s kind of a loophole that - at least so far - Amex hasn’t bothered to fix. I’m told purchasing gift cards works with American Airlines, Southwest, and Delta. Now, I know it works with American, because I have already bought a gift card from them. I'm not sure about the others. 5x on airlines How much do you spend on flights every year? If you include the $200 airline credit and $200 Uber credit (which also includes Uber Eats) you really only need to make up $150 or 15,000 worth of Membership Rewards points to make the card worth the annual fee. That’s $3,000 a year spent on flights, which can be easily reached if you buy two round trip economy tickets to Europe. I go to Chicago (at least) two to three times a year. And I already have other domestic flights planned for the future. I’ll easily spend $3,000 in flights in the coming years. Travel Partners Airlines:

Hotels:

Lounge access If you’re not impressed with the card thus far, you’ll notice that this is where the card really stands out. That’s because it gives you access to, arguably, the best lounges in the country - the Centurion Lounges. Unfortunately, they are still far and few between with only eight in the country:

But if you live in one of the cities that has a Centurion Lounge, it becomes even easier to accept the annual fee. Say for example, Crystal and I are headed on vacation and we’re leaving from DFW. We can get to the Centurion Lounge - which is in Terminal D at DFW airport - from any terminal. The lounge has a full bar, a lot of food options, showers, a spa, and more. All for FREE. Crystal and I can sit down and have a meal and drinks there before our flight, and possibly grab a couple bottles of water on the way out. Saving us, on the low end, $50 and on the high end, well over $100. If you fly somewhat often and typically grab a meal or a couple drinks before your flight, this could end up saving you quite a bit of money. If you fly Delta, you will be given free access to their Sky Clubs. And lastly, you'll be given access to the 1,000-plus Priority Pass Lounges that can be found all over the world. Fine Hotels and Resorts Simply put, it’s a collection of luxury properties all around the world where, if booked, you’d enjoy several perks during your stay. Those perks include a room upgrade when available, daily free breakfast for two people, guaranteed 4 p.m. check-out, noon check-in when possible, a third or fourth night free, and a unique property amenity like a hotel credit or a free ride from the airport to the hotel (or vice versa). Each property has different amenities. American Express says those bonuses add up to an average total of $550 (convenient number, I know) for a two night stay. Now, there are a couple ways to look at this:

My view is a third way you can look at this: you’re going on vacation and money is going to be spent. Whether it goes to a nicer room, some breakfast, a ride somewhere, or something else, you’ll spend the money. So if you can find a hotel that’s within your budget and allows you to take advantage of some of these benefits, why not? Where this perk really shines is if you were going to stay at one of these hotels to begin with. If that’s you - Amex’s FHR is perfect! Bottom line This card certainly isn’t for everyone. The Amex Platinum emphasizes upgrades, premium services, exclusive experiences, and other things that make you feel special when you travel. I've seen those kinds of benefits described as “soft” benefits. You’re not going to get the cold “hard” cash that you would see from other cards. Some of the other “soft” benefits - or I’ve called them, "VIP perks" - that you will get is access to is a concierge, purchase protection, and car rental insurance. But the $550 annual fee is hard to forget. In all honesty, I don’t know if I’ll keep this card for more than a year. I’ll see how much use I can get out of it to determine if it’s worth it or not. You may also like: -Everything you Need to Know About the Chase Sapphire Reserve -Breaking Down Credit Card Rewards and how YOU can Take Advantage -Europe for Two Weeks: Where we Went and How we Paid

1 Comment

Leonardo Morlans

6/28/2019 01:15:39 am

Hey there!

Reply

Leave a Reply. |

Stay inspired with The KKR in Your EmailCategories

All

|

RSS Feed

RSS Feed